The catastrophic injury lawyers at the Wieand Law Firm are frequently asked whether lawsuit settlements are taxable. While most lawsuit settlements are taxable, many elements of personal injury settlements are not taxable. This article will explore personal injury lawsuit settlements in regard to taxability.

The catastrophic injury lawyers at the Wieand Law Firm are frequently asked whether lawsuit settlements are taxable. While most lawsuit settlements are taxable, many elements of personal injury settlements are not taxable. This article will explore personal injury lawsuit settlements in regard to taxability.

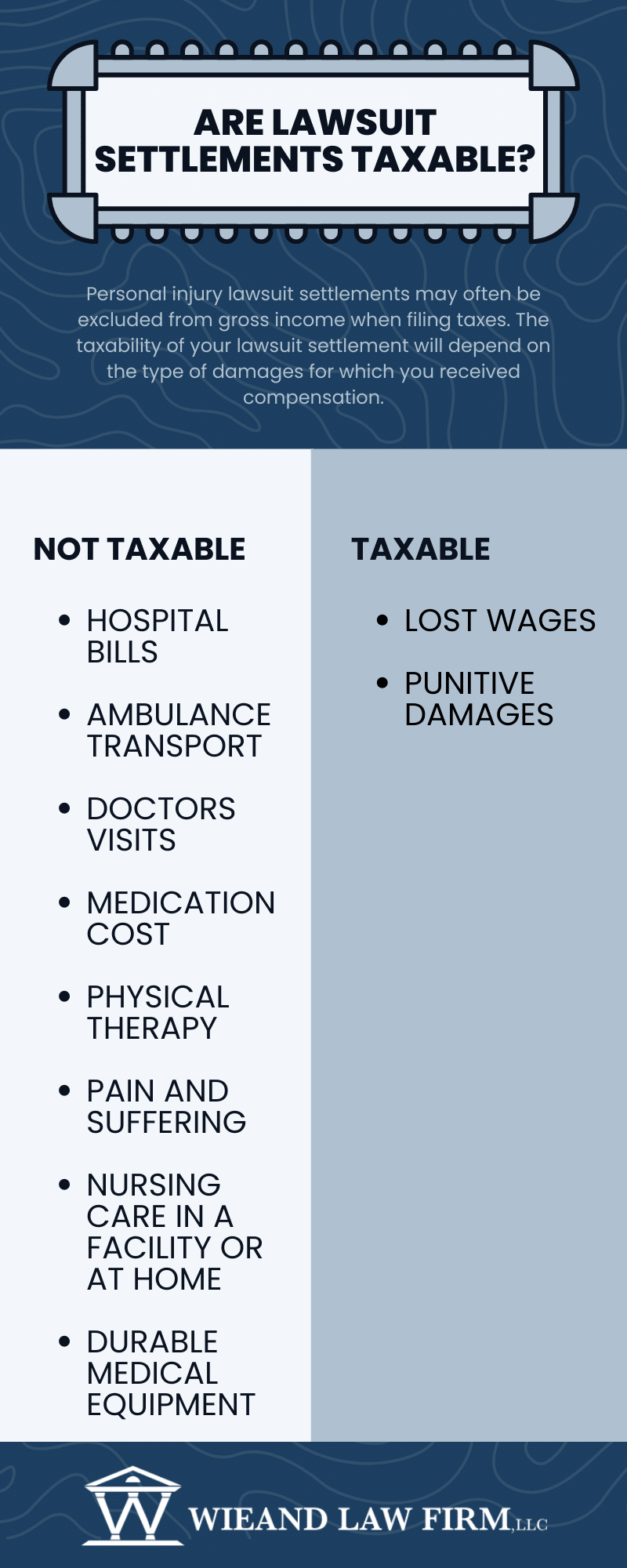

Personal injury lawsuit settlements may often be excluded from gross income when filing taxes. Your personal injury settlement may be broken down into different damages. The taxability of your lawsuit settlement will depend on the type of damages that you received funds for. For example, personal injury lawsuit settlements may include funds for damages such as medical expenses, lost wages, funeral costs, and property damages. Each of these types of damages must be considered separately in regard to its taxability.

Personal injury lawsuit settlements are aimed at compensating accident victims for the losses they suffered to due another person’s negligence. Because these are considered compensatory damages to pay you back for the losses you suffered, many damages from a personal injury lawsuit settlement are not taxable. The damages for medical expenses may include:

Personal injury lawsuit settlements for medical expenses are considered non-taxable if you have not taken an itemized deduction for those medical expenses in prior years. If you filed a deduction in a prior year for these medical expenses, then you may need to include that portion of your settlement in your taxable income.

Damages received for emotional distress and mental anguish are not taxable when they are provided as part of personal injury lawsuit settlements for a physical injury. For example, sometimes a traumatic event such as a car accident can cause not only physical injuries, but also emotional distress that leads to an anxiety disorder or PTSD. These disorders may require medication, medical appointments, and counseling sessions.

Damages for medical expenses resulting from emotional distress are often tax exempt. This compensation is meant to remedy the emotional suffering that you have endured. As such, these damages are compensatory and aimed at making you whole, and this element of your personal injury lawsuit settlement is not taxable.

Yes, according to the catastrophic injury lawyers at the Wieand Law Firm, personal injury lawsuit settlements for lost wages is taxable. It is also subject to social security and employment tax withholding.

Compensatory damages from wrongful death claims are typically excluded from taxable income for the surviving family. These lawsuits are intended to compensate families for the loss of financial support, medical and funeral expenses, loss of future inheritance, and pain and suffering of the victim prior to death. As such, these lawsuit settlements are generally not taxable. However, punitive damages assigned to these settlements may be taxable.

Compensation received for property damages as part of a personal injury lawsuit typically are exempt from taxable income, if the compensation received is equal to or less than the value of the damaged property. If you receive more compensation that the property was originally valued at, you may need to claim a percentage of the monies received in the settlement as part of your income.

While many damages in personal injury lawsuit settlements are considered compensatory to provide the victim relief from their losses, punitive damages are not considered compensatory damages. Punitive damages are typically awarded in cases where the defendant exhibited willful, wanton, or reckless behavior that led to injury or death. These damages are often meant to penalize the defendant for their conduct and deter future bad behavior. Therefore, punitive damages are not considered compensatory damages to offset a victim’s losses.

Punitive damages often are taxable. The catastrophic injury lawyers at the Wieand Law Firm can help guide you regarding the taxability of punitive damages as they relate to your case.

In a broad sense many of the damages in personal injury lawsuit settlements do not need to be reported as income on taxes. Examples of cases that fall within the personal injury lawsuit umbrella include:

Consult with the catastrophic injury lawyers at the Wieand Law Firm regarding settlement taxability and attorneys’ fees. In many cases, attorney fees are considered part of the award, and the IRS may tax the settlement for all the award, even the portion paid for attorney’s fees. An experienced personal injury attorney can explore structuring settlements to reduce tax liability.

Call the Wieand Law Firm today for effective and personalized representation in your injury lawsuit. We understand that each case is different, and each client will have unique needs. Our personal injury lawyers will take the time to do a full case review and evaluation to help you understand your legal options.

We stay with you every step of the process to keep you informed of your case’s progress. Once a settlement is reached, our lawyers can help you understand the tax implications of personal injury lawsuit settlements and connect you with tax professionals as necessary. Call 215-666-7777 or send us a message on the online form below.